Tips to strengthen the cash flow of your business if you market software

Subscription, one of the most desired business models due to its easy predictability. However, COVID also affects the cash flow of the business. If you have a service or product with a monthly subscription, these options can help you guarantee a cash cushion that will give your company some extra oxygen.

1. Strengthen the annual plan

This is surely one of the most important tools of subscription businesses, and one that many do not exploit as much as they should. The advantage of a customer purchasing an annual plan versus a monthly plan has different benefits:

- a. You ensure customer retention for 12 months, avoiding churn at least on this account.

- b. You get an unlimited marketing budget. Yes, as you read it, although this deserves to be explained with some numbers. Let’s assume that your CAC (customer acquisition cost) is €50, your ARPU (Average Revenue Per User) or Average Monthly Revenue per Customer) is 20 euros and your LTV (Life Time Value or total money that a customer leaves you on average over a lifetime) is €250. If you discount the annual subscription by 30%, the customer’s LTV will be €175, right? This means that the margin provided by this customer goes from €200 to €125… a very significant drop! However, by having the client’s 12 months money in advance you will be able to re-invest the 125€ in marketing, which will bring you at least 2 more clients. Of these two customers, those who pay the annuity again will allow you to obtain another 2 customers each, and so on. So… what’s the catch? There really is no trick, if you can motivate the customer enough to opt for the annual plan, the more marketing budget you will be getting. The limitation you will find is in the customer service and operational part, which you will need to structure in a way that is scalable enough to support the increase of customers and not die of success.

- c. You get more cash to weather the storm, since in the end it is still an injection of extra cash to support your operations.

A good strategy would be a mix between option B and C, so that you increase your customer base by growing the business while creating a financial cushion that you will most likely need for the difficult times ahead.

2. Consider a life-time deal

(Or lifetime service) is another alternative that allows you to obtain an income similar or even higher than the annuity in exchange for offering your software to the client for life.

It can be a good strategy to create a specific campaign for a limited time to obtain liquidity quickly. Just make sure your business is operationally prepared to service and support your potential buyers.

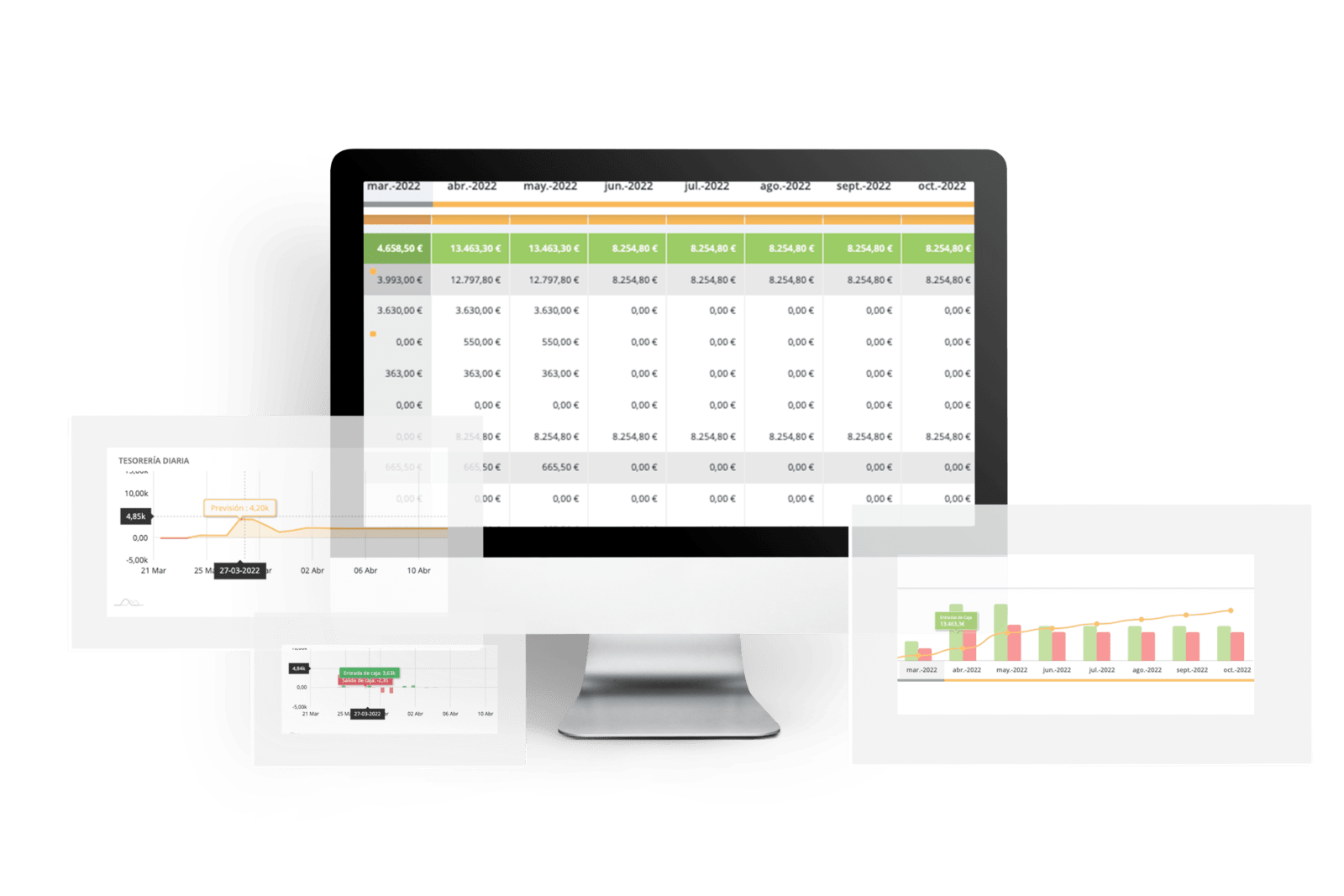

These options will allow you to give more months of life to your company, but… how many? are these actions enough? are they right for your business? Making decisions without knowing the future impact is not always a good idea. It will be important that you have your forecasts and visualize how the business will evolve with these actions.