Product

Rolling forecast

Every treasury at the time the chart is made is a snapshot of what has happened, is happening and may happen in the coming months, but a company evolves continuously, which is why it is the rolling forecast.

These are all realities that are changing the closest future forecasts, i.e. invoices issued and received due in the next few months.

What does the rolling forecast allow us to do?

Obtaining information

To obtain the data we have two systems:

- Manual excel upload: You can upload an excel file with a list of invoices or due dates.

- Integration with ERP (Currently Holded): We request information from your ERP account every 2 hours, so we get the latest invoices issued and received.

At any time you will be able to see the list of invoices in Orama.

- Manual excel upload: You can upload an excel file with a list of invoices or due dates.

- Integration with ERP (Currently Holded): We request information from your ERP account every 2 hours, so we get the latest invoices issued and received.

At any time you will be able to see the list of invoices in Orama.

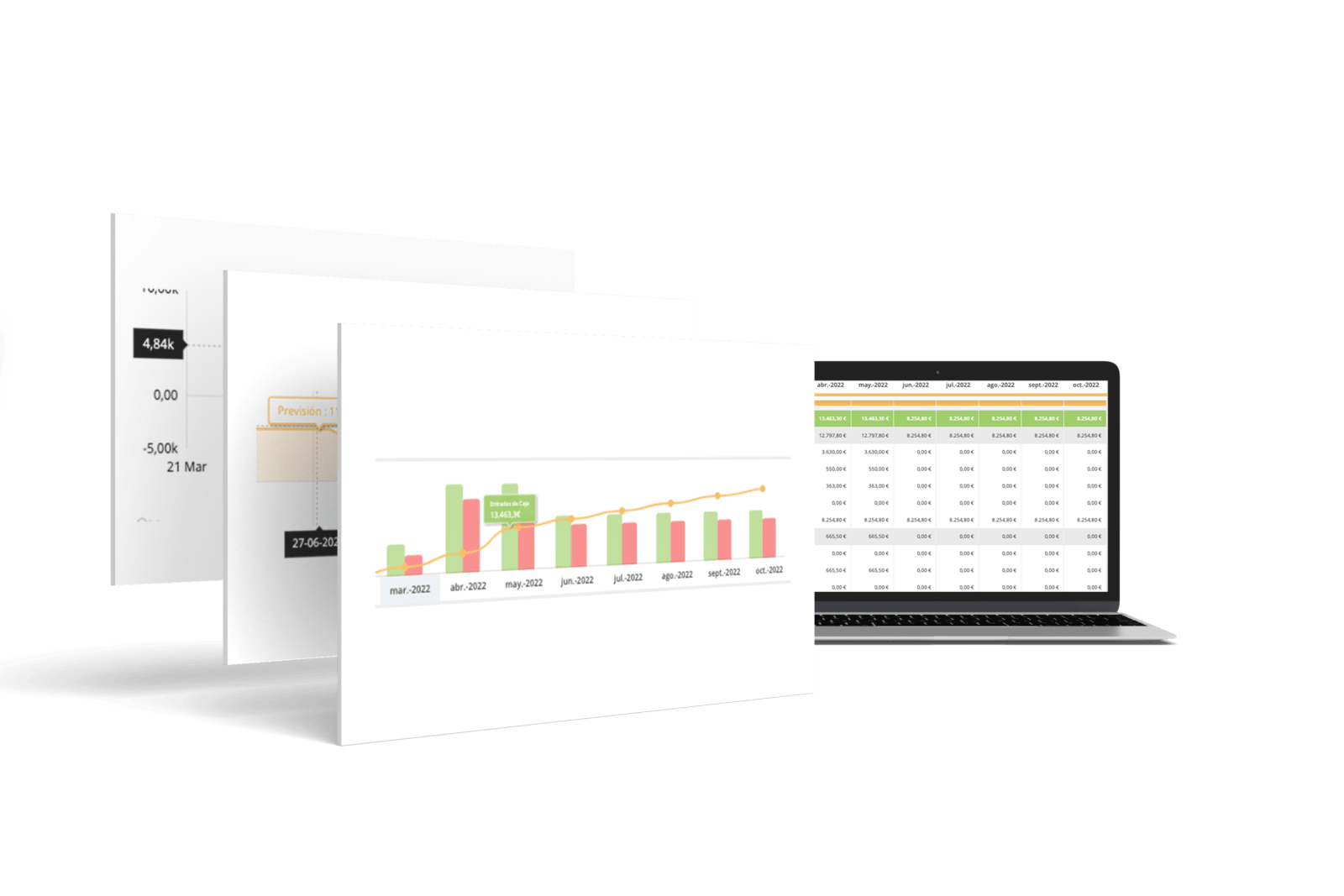

Information analysis

Orama analyzes each invoice and ensures that there are no duplicate invoices, we validate two parameters:

- Issuer of the invoice.

- Invoice number.

- Issuer of the invoice.

- Invoice number.

Invoice - line item reconciliation

As with our transaction reconciliation system, in Orama we have to identify in which line item we want to include an invoice, so we have duplicated the system to identify these items, and has automatic reconciliation! In this case, we search in the customer or supplier identifier, in its fiscal name, or in keywords that we have in the invoice itself, all this to make it as simple as possible.

Update of forecasts

Orama automatically modifies the forecast closest to the due date and eliminates the total amount of the invoice, creates a new cash forecast for the due date of the invoice and finally depending on the date of invoice creation in the special VAT item creates a due date for the amount of the tax, either positive or negative.

Orama does everything

for you

So you can focus on running your business

Subscribe to our Newsletter

Receive all the latest news, releases and news in your email.