The liquidity of SMEs is also in a state of alarm…

Unfortunately, the Coronavirus has had and is having a very significant negative impact on the financial status of small businesses, in many cases making it very difficult for them to stay afloat. Many businesses have gone bankrupt, many others will do so in the short and medium term, and those that manage to survive will see the footprint of the pandemic reflected in their revenues, workforce, customers, suppliers, and in general in the entire ecosystem in which they operate.

The confinement has brought a good part of the sectors to a standstill, people have not been able to go out, customer payments have been delayed, and with the current situation the future is hardly predictable. This is the new normal.

Businesses are seeing their cash flow shrink by the day, and reserves do not seem to be enough to survive indefinitely if the situation does not change. If we consider that in a pre-coronavirus situation 82% of businesses close their doors due to poor cash management and forecasting, the present scenario exacerbates the risk of small businesses running out of cash, and multiplies the importance of making the most appropriate decisions to ensure that the company survives this difficult period.

But this is only the beginning, as the effects of current and future company bankruptcies will translate into higher unemployment, and this in a further decline in sales.

If we bring all this uncertainty down to the day-to-day management of an SME, these questions will inevitably arise:

- What is the current financial health of my company?

- How much cash will I have in the next few weeks?

- How many invoices should I pay in the short term?

- Does my company have sufficient cash flow?

- For how long is there sufficient cash flow?

- Are all my customers going to pay me?

- Who exactly? When? And… how much?

- Am I having costs above what is really necessary?

- How much money does it cost me each month to keep the company open?

- Will I have enough money to pay my employees’ salaries? and the rent? and the bills?

- Do I have enough liquidity to pay my suppliers?

- How can I reduce my company’s risk?

- How many proposals, or potential billings do I have in my pipeline?

- What decision should I make?

- What will the future of my business look like?

Now more than ever, entrepreneurs will need to know how to answer these questions, and take control of their business by understanding where the money is going, and what the future of the company will look like in order to anticipate and make the right decisions to achieve the best possible outcome for their company after the impact of COVID-19.

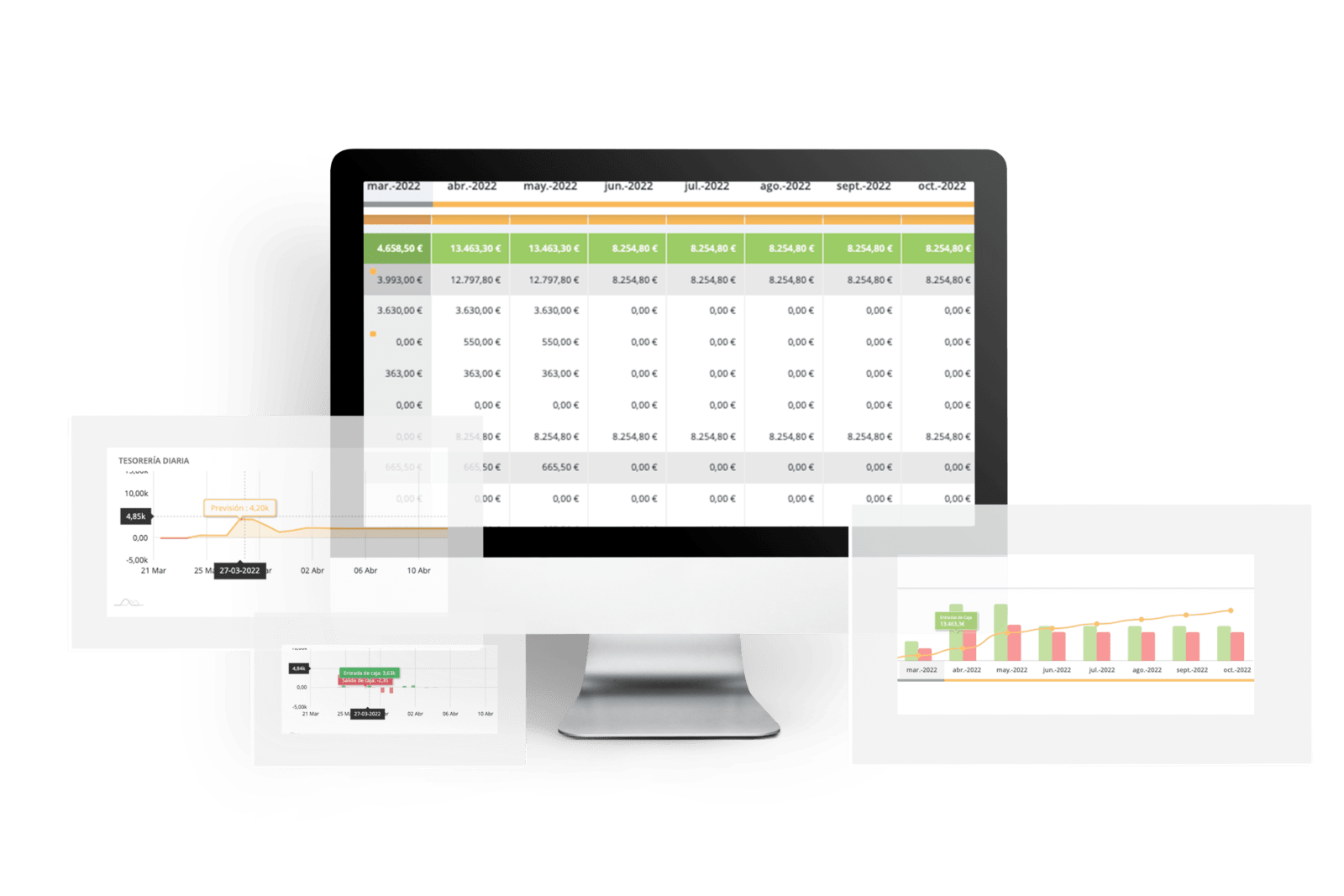

Of the 100% of Spanish SMEs, 37% do not make any type of cash flow forecast, and 45% do it in Excel, with all the work involved in creating and updating it. At Orama our mission is to provide an affordable and intuitive tool for small businesses to understand their financial health and anticipate any type of liquidity problem.

4 essential steps to be able to react to unforeseen events in your business cash flow in the current situation

1. Don’t make blind decisions: No, don’t cut expenses, don’t make layoffs, don’t close any doors…not yet. First, be very clear about what can happen in your business, and the only way to do this is to make a cash flow plan that helps you visualize what will happen in the coming months with your collections, payments and cash flow of your company. Once you have a clear vision, it will be time to make decisions, but with all the possible data to ensure that they are correct. Make supported decisions based on facts, not fears.

Be reactive: Do you already have your cash flow forecast? Fantastic! Dust it off and update it permanently, use it as your tool to predict the future of your business and make the most appropriate decisions with all the information possible with the help of the steps we provide below.

The new normal is changeable, and we need to be comfortable with our forecasts. To this end, we must keep our treasury plan permanently updated; the more you foresee, the fewer surprises you will have.

3. Let your cash budget drive your decisions: If you have an up-to-date cash flow forecast, you will be able to visualize the most critical moments of your business in the coming months, and understand what they are due to. Create your cash flow plan based on what you know, not what you think will happen.

4. Create different scenarios: Do not limit yourself to having a solid cash flow forecast, it is advisable to create different scenarios (at least one pessimistic and another a little less pessimistic) and take your next steps taking into account all possible options. This will allow you to secure each decision a little more, and to visualize the impact that possible future alternatives may have on your business’ cash flow.

You can find several excel templates to control your future forecasts, remember to always update them with the bank movements of your accounts. Or simply make your forecasts in Orama.