What is transaction reconciliation?

To keep your cash flow forecast up to date, you should remove from your forecasts the collections and payments that you have already paid or collected. This process is done through the reconciliation of bank transactions with their corresponding forecast.

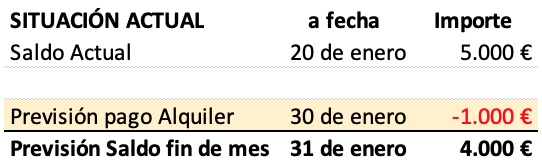

For example, if you have a balance in your bank accounts of $5,000, and you expect to pay office rent of $1,000 at the end of this month, your forecast will indicate that you will end the month with a total bank balance of $4,000.

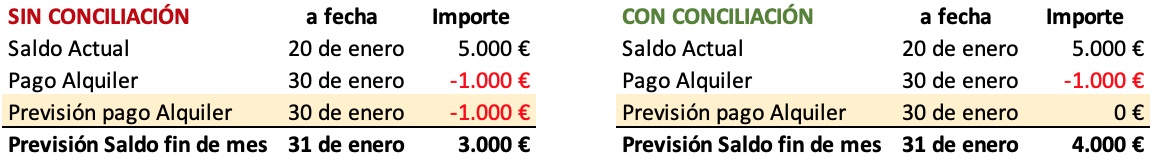

By the time you pay for the office, your bank balance will have dropped to €4,000, so you must reconcile this item in your forecasts, otherwise your forecast bank balance at the end of the month would be €3,000 as you still have the forecast rent payment of €1,000.

As you can see, by not doing a reconciliation, you expect to end the month with €3,000 in cash, which is wrong. However, when you reconcile you update your cash flow forecast by correctly forecasting to end the month with €4,000 of cash in banks.

Orama automatically collects all your bank movements and assigns each movement to its corresponding forecast so that this task is much easier and you can have your cash flow forecast updated at a glance!