Runway: how long will my business last? Every CEO needs to know if at some point his or her business will run out of cash to meet payments, but more importantly to know the exact timing of when this will happen.

Well, this is the Runway, the metric that indicates the number of months your business can last if your cash inflows and outflows remain constant. It is important to take into account the difference between the runway and a specific moment of cash flow tension, since if you estimate that your business will have a specific period of negative cash flow, the alternatives to solve it are very different.

How to calculate the Runway?

Runway = Total current cash ⁄ Average monthly cash burned = No. of months the business has left until it runs out of cash.

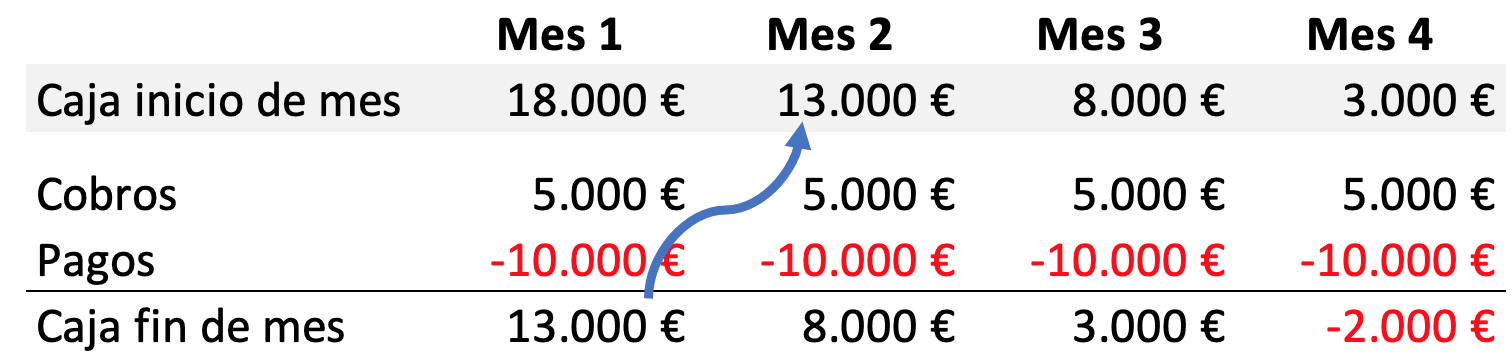

Let’s look at a simple example:

If a company has a current cash total of £18,000, average monthly payments of £10,000 and average monthly collections of £5,000, this returns that the business loses £5,000 per month in payments (or Burn Rate). It looks bad.

The calculation of theRunway would be = €18,000 / €5,000 = 3.6 months

But it is important to understand how many months we have to get this situation to change, and to create strategies that will work before the date when the business runs out of cash.

But… is this the best way to know when my business will die?

The quick answer is NO.

A business is alive, and the decisions you plan to make in the future will affect when your company will run out of cash. The Runway shows the result of a calculation based on historical information, but does not take into account the variations that your new sales strategy will have for the coming months, the new suppliers you plan to have, or the cost reductions you are planning to make. These decisions radically affect the Runway of your business, either shortening it or (hopefully) increasing the number of months your company will survive.

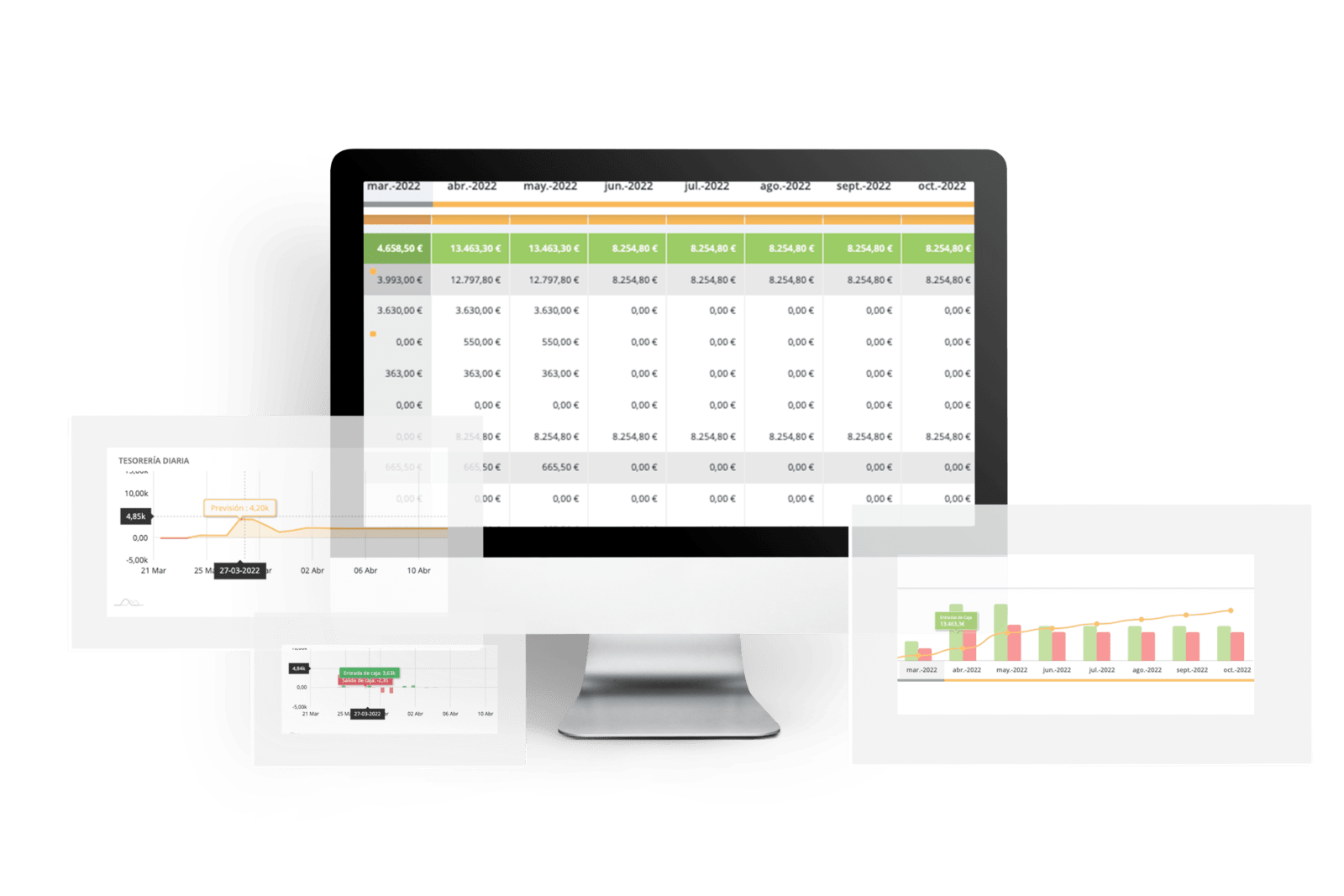

To have a realistic estimate of when your business will run out of cash, the ideal is to have a forecast for each item of receipts and payments of your business, from the estimate of sales, to the forecast of payroll, software payments, rent payments, leasing… and so on for each of the items of the business. It is not always easy to create a forecast for each business concept, it is advisable not to leave anything out, and for this you will need to review the historical receipts and payments of the business and try to cover everything by creating a long-term cash budget. Another option is to use an automatic cashbox categorization and forecasting tool to help you with this task.

Once you have your long-term forecasts, you will have a more reliable view of how your cash flow will behave in the future. With this planning, it is time to simulate the decisions you have in mind to understand how it will affect the company’s cash flow, and therefore how many months the Runway will increase or decrease.

Calculating your company’s Runway when you have a more complicated cost and revenue structure can be a complex task, and mistakes can be made when making more disaggregated estimates. Orama helps you create and control forecasts for your business and understand exactly what your Runway will be. Try it HERE and start making data-driven decisions.