Financial forecasting for startups: Among the 20 most frequent reasons for failure among startups, the second reason is lack of cash (29%). Despite being one of the main problems, it is rarely prioritized to make a good financial forecast for startups .

When structuring the company, it is key to plan finances through projections and the creation of different scenarios. That is why having an updated cash control will help us to know the financial health of your company.

FINANCIAL FORECASTING FOR STARTUPS

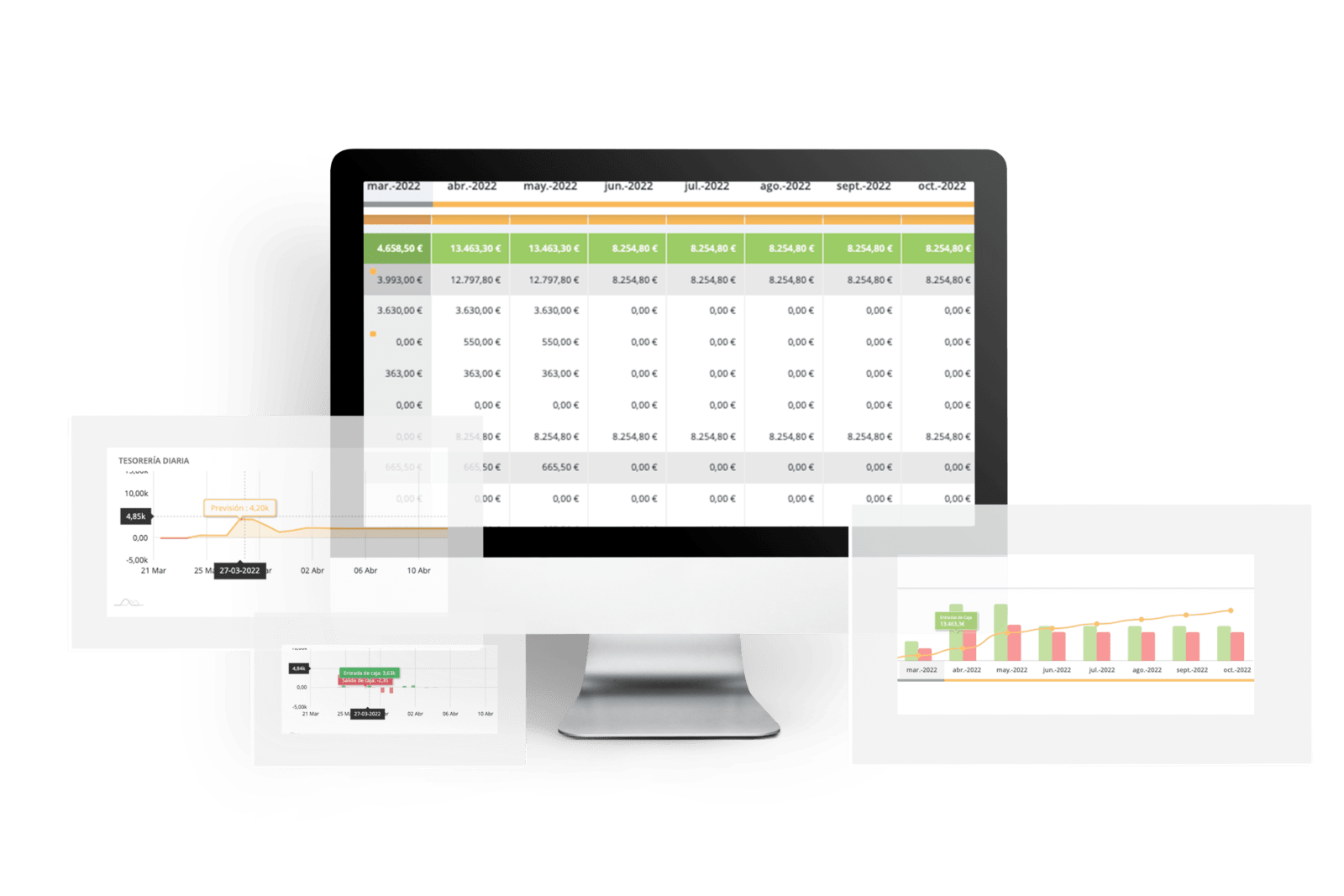

This is the monthly summary of collections and payments to be made within one year. This is part of the financial plan, which is an essential business planning document.

The financial plans compile all the detailed and quantified information of the plans and objectives that will develop your company. It is important that all areas of the business operation appear in this document.

It is important that there are different ways to make and structure the financial plan. The CFO is in charge of following up and designing this document, so we recommend that an expert should mark the characteristics of this document.

FINANCIAL PROJECTIONS

In order to have a good financial forecast in a startup, financial projections are needed. These allow the analysis of historical and current performance in order to plan the future of the company in terms of expenses, income and investments.

They are usually done on an annual basis and are based on different variables, depending on the business model and the historical analysis of the company, in case it is a stable company with a lot of verified data and years behind it. In this way, we will be able to estimate the situations in which you may find yourself in the company and act accordingly.

One of the keys is to make cash flow projections. With these we will be able to know from where we are coming in (where the cash will come from): accounts receivable, or loans, a line of credit…

ADVANTAGES OF GOOD FINANCIAL PROJECTIONS

- They help to explain better and quantitatively the business opportunity, which is key to attract investors to your company.

- They make it possible to establish how the expenses that will allow the business to operate will be covered.

- They show the financial health of the company and the situation in the market it is in (whether it has grown or stagnated).

- They reduce uncertainty, as they are constructed based on real and verifiable data. That is, by constructing different scenarios that can occur, it allows us to see different possible futures (without taking into account that there are variables that are unexpected and there is always an inherent risk). The objective is to be able to visualize the most relevant and plausible scenarios in order to be prepared.

In order to be able to make good financial projections, we need to have the cash flow updated and up to date, so that we can accurately assess the different scenarios we have.

In short, financial projections allow the startup not only to react to imminent potential scenarios, but also to anticipate unlikely scenarios and to make adjustments as soon as revenues or expenses are altered.

With Orama you will be able to make long term forecasts (12 months) of each payment and collection concept of your business automatically.

Book your demo with one of our specialists and start having effective and automatic forecasts for your company.