Financial control is a fundamental part of the management of any company, becoming one of the most important activities of the financial departments of medium and large companies, as well as of the CEOs in the case of small or micro companies. It is therefore of vital importance to understand not only what financial control is, but also what objectives it pursues and how to carry out the financial control of a company .

What is the financial control of a company?

Financial control is the study and analysis of the actual results obtained by any company in order to compare these results at specific moments with the company’s medium and long-term objectives and strategies. Thus, the purpose of financial control is to ensure that there is no deficit between the company’s expenses and revenues.

Undoubtedly, financial control is a fundamental activity in any company, since it is essential to ensure that the accounts are correctly balanced.

Types of financial controls for your company

There are three main groups or types of financial controls. They are as follows:

Immediate or directional financial control: Consists of knowing in maximum detail the financial situation of the company at any given time. This type of financial control is usually based on the general financial statements -those prepared at the close of each company’s fiscal year-.

The objective is to control and prevent any deviation that could compromise the general objectives set by the company.

Selective financial control: The difference between selective and directional control is that it is a more specific monitoring method. While directional control focuses on the company as a whole, selective control brings together all the departments to establish an individual control of each one of them, we will take out the magnifying glass and review in greater detail. In this way, it is likely that one area is meeting the proposed financial objectives and another is in need of a corrective measure.

In the cases of central departments such as HR, administration or technology, these objectives will be more focused on those spending limits; however, commercial departments or those operational departments that have a direct impact on sales will control more the sales process itself to ensure that the budget is met or even improves on expectations.

This review is usually carried out by the Financial Controller in medium-sized companies, always supervised by the CFO, but in small companies where there is no financial team, it is the CEO’s duty to carry out this follow-up in order to have a good control of all the items that were initially budgeted.

Subsequent financial control: While the company’s finances and control were monitored in real time by the previous methods, subsequent control focuses on the analysis of results at the end of the year.

The ultimate goal is to determine whether the financial strategy set by management has been successful, or whether budgetary decisions need to be made for the coming year. How far have we deviated from our sales target? Have we incurred higher costs? Is it justified? Have we achieved the expected gross and profit margins?

How to keep financial control of a company

Proper financial management is crucial, not only to survive in a changing economy, but also to survive in a highly competitive market. In order for your company’s finances to meet the objectives set by financial control, we recommend that you take into account the following tips:

Reduce your average collection time to the maximum. The sooner you collect your invoices, the sooner the circle is closed. A high average collection period for your invoices will mean that you will need to finance this lack of liquidity in some way, either with credits or with cash surplus, but you will always have an opportunity cost when using this liquidity to cover the collection periods of your invoices. Try to reduce them to be able to use that cash surplus in other actions of your company, or simply to avoid asking for more financing and its corresponding financial cost. In this way, the financial objectives will be less distorted and the company will see a better correlation between what is invoiced and what is actually collected, thus improving the picture of your business.

Avoid interest on late payment of taxes. Keeping your tax obligations up to date will prevent you from facing possible penalties and other unexpected expenses. There are ways to defer the payment of these taxes, but always try to avoid delays compared to what has been agreed with the AEAT, since the interest for late payment is very high.

Control eventual expenses. Unexpected expenses are difficult to control and monitor, and sometimes represent a high percentage of our total costs. In addition, it is easy for them not to be included in the annual budget, which can lead to a significant deviation from our objectives.

Economically evaluate the new expenses. It is very common for SMEs to emulate the expenses of large companies by acquiring tools that they will never make profitable. A simple business case should be made to understand the viability of your purchase/hire:

- Value the direct or indirect cost of the tool: It calculates the cost that the use of that tool will represent in the company, not only the cost of its purchase/subscription, but also the indirect cost that the use of the tool implies, either in personnel resources, learning time, or in inputs that the tool itself needs.

- Value the cost of your current process: Estimate the current cost that the process implies without the hiring of the tool. Many times we will realize that there is not as much savings as we thought.

- Assess the potential additional income: Estimate the additional income it will bring in, if any, and when that income will start flowing into the cash flow of the business. Time is very important to take into account in these estimates, since it will not only be the comparison of what it cost me before versus what it costs me now, but also the time I have to finance this cost until the new tool starts to be profitable.

How to keep financial control of a company

To make these estimates, you can find tools that will allow you to visualize how your decisions will impact your decisions. Don’t know where to start? Visualize your decisions here.

Outsource processes: Outsourcing services such as accounting management, payroll management or similar processes that are not the core of your business can be a great idea to keep costs contained but at the same time have a company that has a specialized team and well-designed processes to meet your needs effectively. For SMEs, any internalization of processes that are not part of their main commercial and operational objective is usually not the best option if they have not reached a sufficient size to become more efficient.

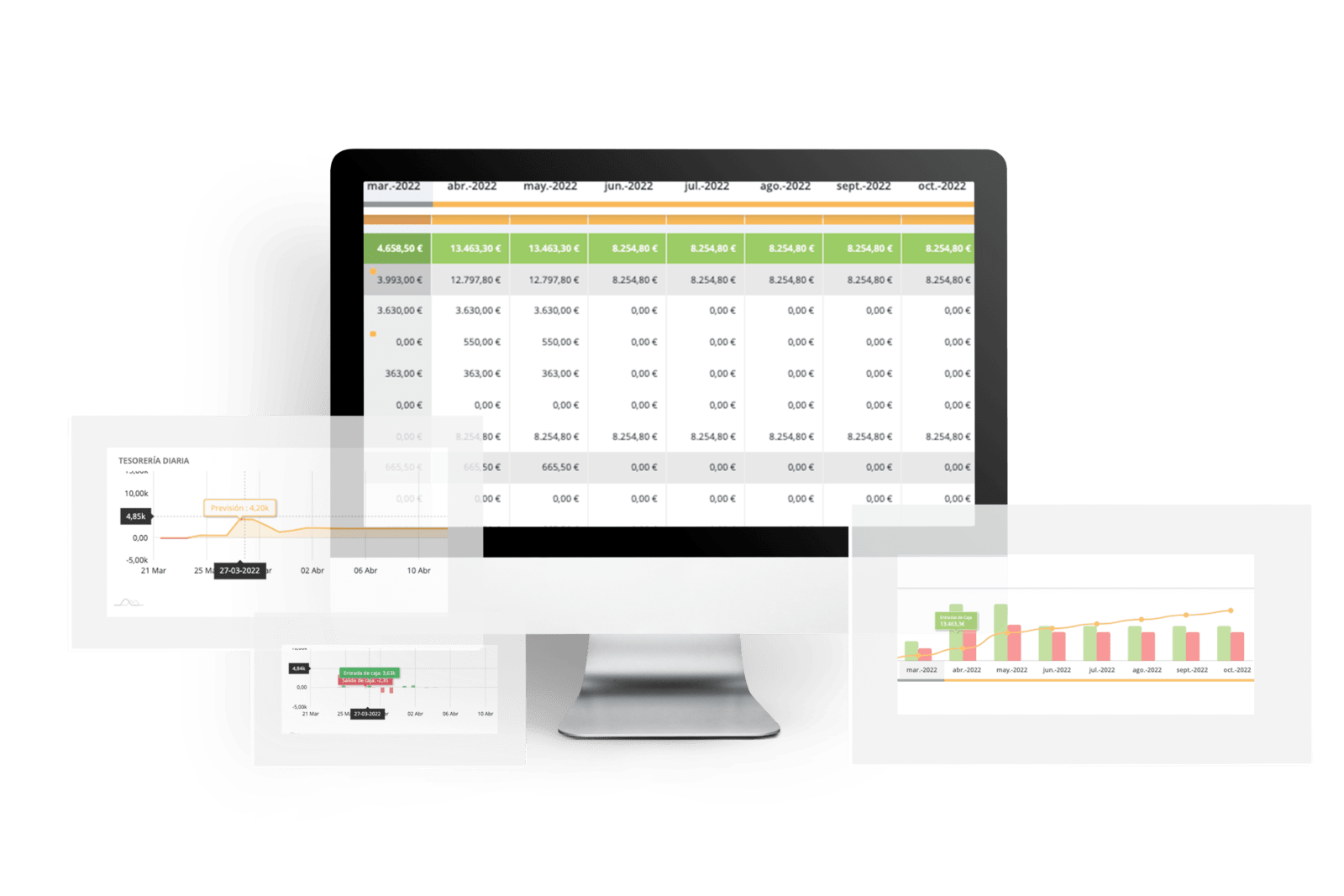

Invest in financial control tools: Although financial control can be done manually, as we have already mentioned, it can be very complex and elaborate. financial control software that allows you to control your business efficiently by automating processes and providing you with adequate reporting.

Plan your funding request. Getting into debt is not a negative thing; it is a natural process that can help your business grow when you need liquidity. However, credits should be a tool that allows us to stay on the path to higher profits. Interest rates and settlement periods are very important aspects to consider before contracting, and include them in your projections to understand if the amount to be financed is sufficient to meet your objective, and above all, if the business will be able to meet the repayment of such financing. Don’t hesitate to use a tool to help you plan the type of financing your business needs.

If you want to know more tips on how to reduce expenses in your company, take a look at our post dedicated to the types of expenses and how to reduce them.