Along with working capital analysis, knowing and mastering cash flow management for non-financials is key information for any company founder or CEO. This is because it is key to know how resources are generated and how your company is self-financed. In other words: it tells you the health of your company.

Contrary to popular belief, it can be quite simple to calculate cash flow for non-financials:

Cash Flow = Net Income + Depreciation, Amortization and Provisions

Net income should be considered after cash inflows and outflows have been subtracted. Subsequently, in order to know the final amount available, provisions and amortizations must be subtracted from the previous amount.

This way of calculating cash flow expresses the company’s capacity to generate funds through its operations. It is identified with the resources generated by the company during a given period, since it is the differential between revenues and disbursable expenses.

It is important to bear in mind that depreciation and provisions are an expense for the year, but do not represent a cash disbursement:

Cash flow = Revenues – Disbursable Expenses

LIMITATIONS

Although cash flow is an essential calculation to know if a company is on the right track, the above calculation formula (the sum of net income, depreciation and provisions) has a limitation: the accrual rule.

What is happening? This rule refers to the fact that accounting profits are considered cash, which is not entirely true. That is, when the invoice for a sale is sent, it is counted as profit as part of the company’s assets, but that does not mean that the company has that money in the cash.

As an immaterial concept that is based on immaterial company transactions, there is a possibility that this could cause a domino effect: if there is a payment that the company does not receive, it may not be able to pay its suppliers.

CASH FLOW MANAGEMENT FOR NON-FINANCIALS: HOW TO DO IT STEP-BY-STEP

We know that Cash Flow has its limitations, but its calculation can greatly benefit the company (and its CEO).

First of all, Cash Flow helps you to analyze the company’s financial situation. In other words, it lets us know whether or not the company has liquidity problems. Before a company realizes that it is no longer profitable, Cash Flow allows us to detect the problem early and solve it in time.

In addition, it also allows you to analyze the viability of investors within the company, as well as to understand how the business is growing.

HOW TO IMPROVE CASH FLOW

Sometimes we may find ourselves in a situation where the company is cash strained and in need of liquidity. Therefore, in order to improve the company’s liquidity and its associated cash flow, we will need to get more money coming in than going out.

To do so, we recommend limiting expenses and taking advantage of some early payment discounts from suppliers. In addition, you can renegotiate payments with them, but it is important that you take them into account in the following calculation.

In short, cash flow is a key indicator of the health of the company, beyond the apparent results and profits. In addition, it is important to have it in real time to know the real status of a business and anticipate possible liquidity problems.

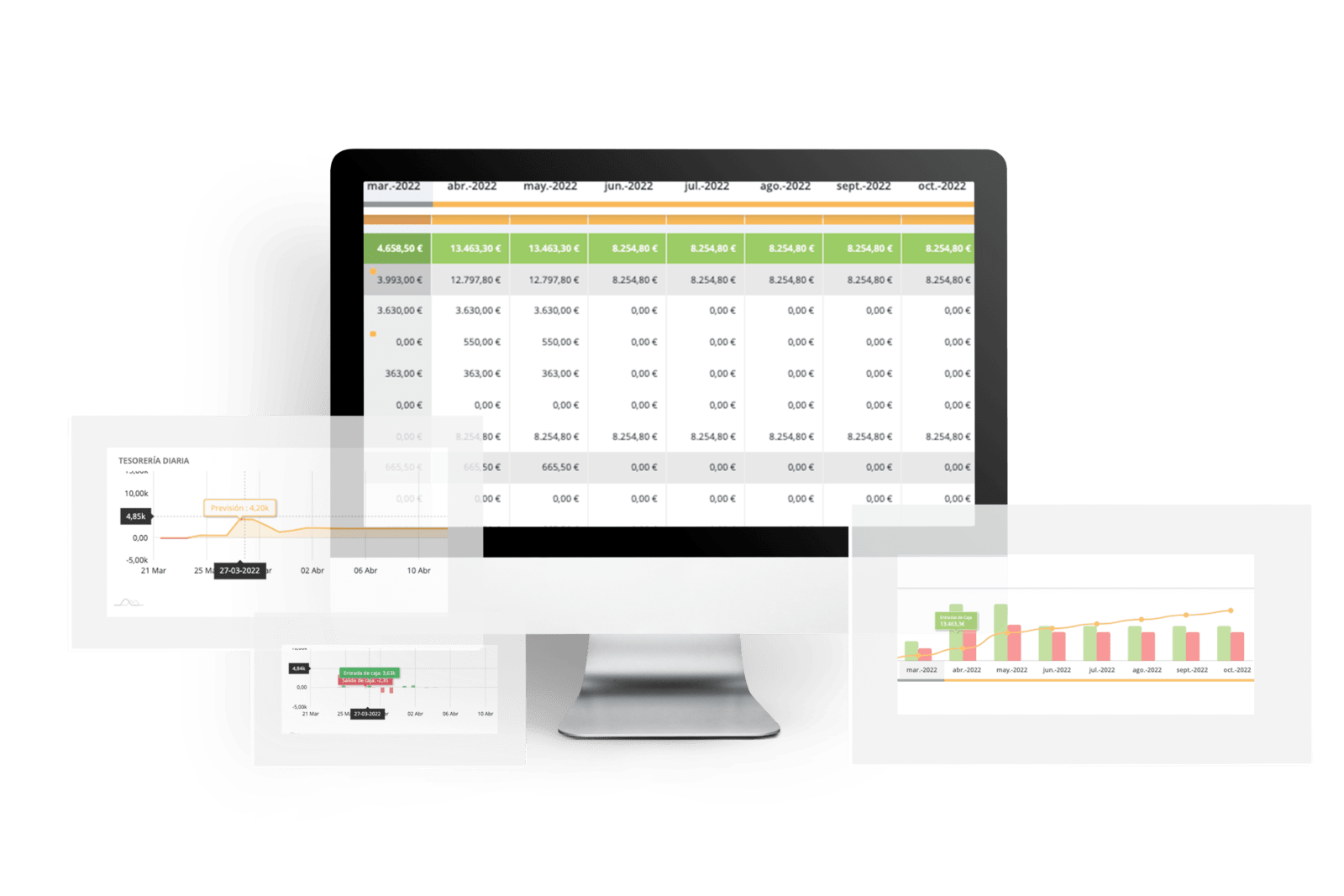

Orama is a tool to control the past and future of your business in a simple and well organized way, even if you are not a financial guru. Book your demo and one of our consultants will show you the potential of Orama applied to your business.