Within the general corporate planning we must take into account the financial forecasting for companies, a process that consists of reflecting the company’s financial statements that reflect the company’s business model, acquisition, monetization and cost structure. In other words, we can obtain projections to see whether our project has viability or profitability for the future.

What should it include?

A financial forecast should include projected revenues, assets, liabilities and cash flow, and those that are even more strategic will also take into account operational KPIs.

How do we make a financial forecast?

The following elements must be taken into account in order to correctly carry out the financial forecast :

- Initial capital of the company: the initial capital we have must be taken into account in order to be able to carry out the financing plan correctly, in addition to knowing in advance what actions we can carry out.

- Profitability: after having made the financing plan we have to see if our company will be able to follow it, that is to say, if it will be profitable in the first term.

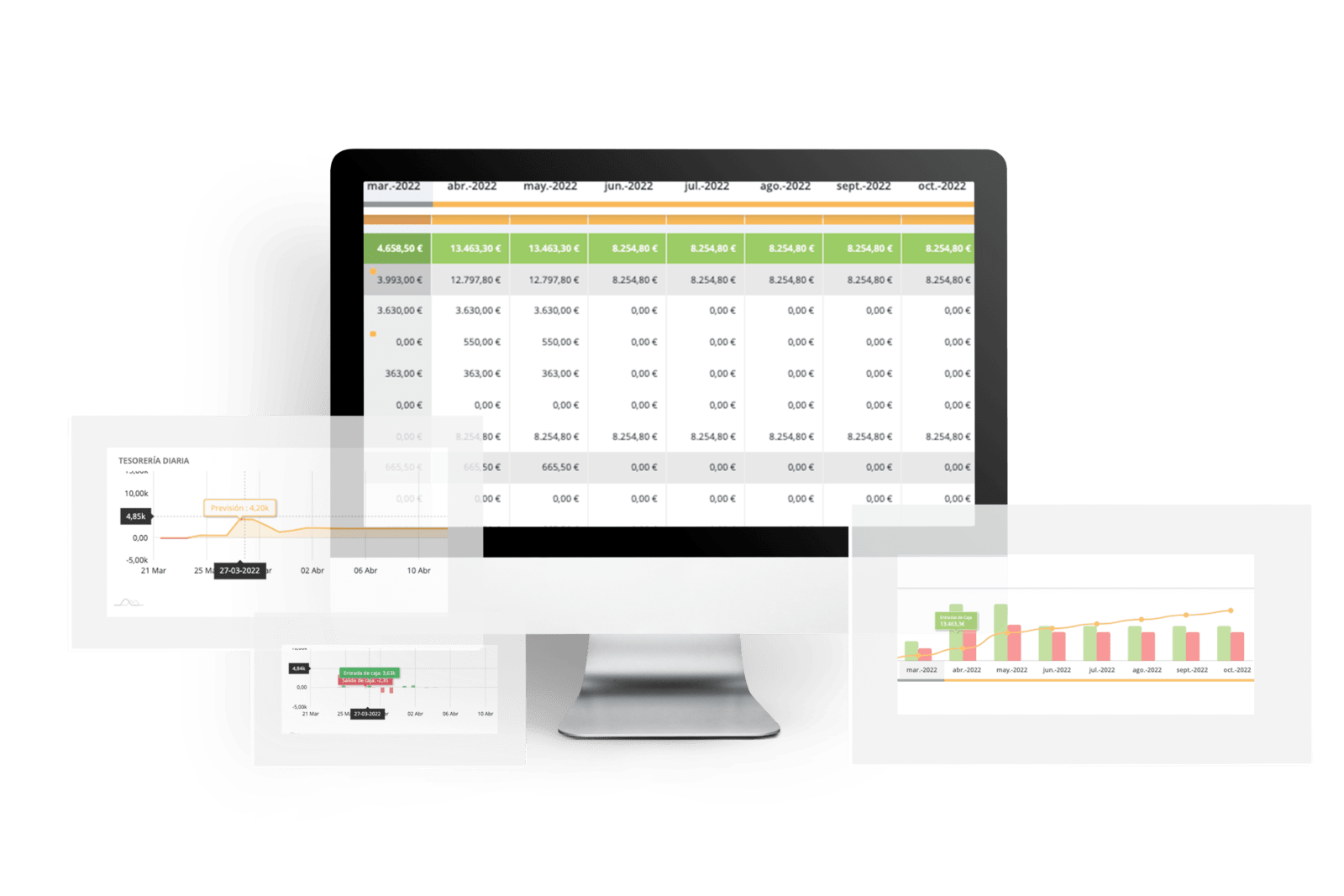

- Cash flow plan: together we have to follow a plan that tracks the collections and disbursements made month by month in order to have an estimate.

- Break-even calculation: it acts in the same way as the cash flow plan, but covers longer terms.

- Financing plan: With this financing plan we must cover even longer terms, between 3 and 5 years, where the company must be able to maintain the initial plan, but with which we must be able to organize a structure in which the weight of the execution of the project falls.

The importance of having a financial forecast in our company

In order to move forward we need to have a financial forecast, this way, we can get a picture of the possible results we can obtain with our business plan. Let’s say that we have the possibility of having a long-term vision of the investments and expenses we make, in addition to insuring ourselves and not moving forward with the risk of failure.

To sum up…

The concept of forecasting evokes the term estimation, i.e., looking into the future. In the case of the financial and corporate sector these forecasts will be used for business planning of operations and to make effective the possible impact that our management decisions may have on the financial situation of the company. Likewise, before making any forecast or estimate of what may happen with our company, we must have carried out a good strategic and budgetary planning process to see how our objectives as a company are developing.

Book your demo with us and learn how Orama can help you with your 12-month forecasts.